Automated Accounts Receivable Programs: Cutting DSO by 30% in Six Months

In today’s economy, speed to cash is as important as speed to market. Companies that let receivables linger for 60, 75, or even 90 days are putting...

For many companies, the fourth quarter represents some of the most challenging times of the fiscal year. Besides an often frenetic push to hit revenue targets, frequently driven by end of year promotions and holiday initiatives, you have a glut of planning activites that are layered on top of already busy staff. Couple this with the financial reporting responsibilities of year end activities and you've got the perfect storm....of fun stuff.....riiiight. Having worked with finance executives, managers, and staff for years, we get it. There are many things you can doing in the financial back office that is accounts payable, but there are times when you have to lift your gaze beyond the pale to consider other, better options for the way things get done. With respect to b2b payments, we believe there's a mighty strong case for partnering with an organization focused on streamlining this nuanced area.

B2B payments represents a shifting area that is demanding and multi-faceted for virtually every business that is trying to keep pace with the rapidly changing payments arena. As we've discussed previously, there are already a plethora of things to consider when looking into b2b payments strategy, we’re going to describe below but the key take-away from this post is that you need not go it alone. It's been said that experience alone is a tough taskmaster, and that there's wisdom in walking in the steps others have taken. In other words, you can bypass some of the mistakes and setbacks others have faced in the business to business payments arena by gleaning wisdom from those who've gone before. As the good book says, "by wise counsel is a successful war waged".

So as we explore business to business payments a bit in the ensuing paragraphs, we want to make the case for the wisdom in gleaning counsel from where others have walked. If it helps you in the process of evaluating your current payments landscape, and reflect and think on the art of the possible as it pertains to transforming AP payments.then we've done our job.

If you've not already automated front end invoice processing, then you're extraordinarily busy with invoice entry, validation, 2 or 3 way matching and the like. We've got a ton to say about gaining leverage over the process and making it as effortless as possible, and you can check that out over here.

However, if that is the situation you're stuck in right now, optimizing business to business payments is not probably top of the fold for you because you're probably behind the eight ball from a workload perspective already. Ancillary things like shifting the payment type to a more strategically valuable one is something that is done with a high degree of intentionality and if you're people and your process are barely keeping you above water, then what are the odds you're getting to high value accounts payable priorities, when the basic ones are bogging you down.

The point here is with the right b2b payments partner, you gain the personnel leverage that they have to offer, specifically in areas like vendor outreach and onboarding. A major consideration for virtual card payments, which is a subset any solid b2b payments partner is going to have serious command of, is that said partners can quickly assess which companies are likely to accept card payment technologies based upon established card networks and databases of previous spend data.

With this said, you can quickly get on the road with virtual card payments, reap their rewards, and identify the vendor base that will require additional outreach. Done correctly, this outreach effort can be offloaded to the right payments partner and they can lever the time value of money to gain mindshare and card acceptance amongst your vendors.

According to research from Deloitte Consulting, the global payments market is estimated to hit $23.1 Trillion dollars by 2020.

While we don't know everything in this space, we know that's a lot of zeros. We also see in the data from Deloitte that payment trends are shifting, as ACH is set to displace check consumption by 2020 as well.

The other thing we're keenly aware of is that there are myriad payment types that are available for use: cash, checks, wires, ACH / EFT, virtual cards, cryptocurrency, and the list goes on. This is difficult to keep up with on your own, let alone the things that technology portends in the future. Business to business payments partners have deep command of the space, and the vision and ability to adjust to the disruptive changes of the digital age we're in and accelerating through.

Specifically, we're talking about companies in the $50MM-$1BB range. Again, according to Deloitte, this segment of the economy represents a $6.6 Trillion dollar chunk of the US economy and one that is growing rapidly. Deloitte bandied about the words "tectonic shifts" to the payments landscape for this segment of companies and we believe this largely has to do with the lack of resources and variegated b2b payments landscape.

As such, there are many business to business payments partners that are geared up to serve this market, which should facilitate some positive outcomes for both parties. The upside to this is that by switching to modern electronic b2b payments, you can minimize the costs associated with traditional payment means and pave the way for sustainable cash rebates in to the business via virtual credit card payments, thereby flipping accounts payable from a cost center into a profit center. We touch on this over here (is there supposed to be a link?), as one of the key pillars to maximizing the potential value of the AP process.

.jpg?width=371&name=Middle%20Market%20Pain%20Points%20(1).jpg)

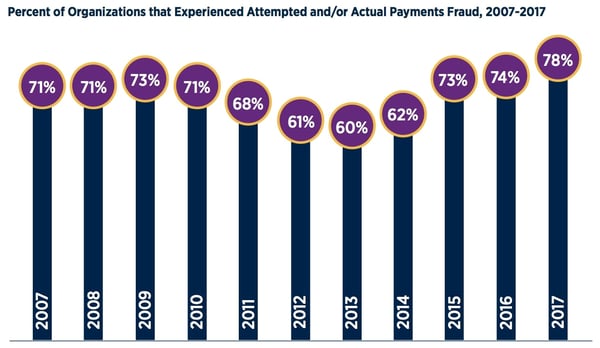

Not surprisingly with the proliferation of b2b payments and the various electronic mediums they encompass, hackers are growing more brazen and sophisticated in their schemes to defraud payers. A shocking stat from the Association For Financial Professionals 2018 AFP Payments Fraud and Control Survey report where they assessed 682 different companies, nearly 78% had reported an incident or attempted incident of fraud in 2017.

This is staggering and one of the conclusions of the article is essentially that the average company is woefully ill-equipped to prevent these types of events from happening left to their own devices. As such, by joining with a b2b payments partner, you can harness the strengths, protocols, and security measures by solid fintech institutions that proactively engage countermeasures against fraud incidents.

Things like positive pay, duplicate payment detection, hierarchical automated approval workflows with division of duties, and two-factor authentication for payments are all building blocks for creating a dependable and secure payments infrastructure. Further data from the same report suggests that the impacts to the bottomline are not nominal, but represent a full .5% of top line revenue in negative impacts from fraud incidents.

This is a bit more of an outlier to the overall conversation, but there are tools in the market that can make reconciling and ingesting whatever payment stream they're taking in much easier. For instance with regards, to virtual card payments, where your vendor's accounts receivable team will have to pull in and reconcile card funds, there are tools from third party provider that afford high levels of robotic process automation to expedite payment processing and minimize human involvement. This can't be overlooked because it eliminate a critical barrier to adoption for this payment rail.

As we've touched on in previous content briefs we've posted, there's a broad range for payment processing costs. The point here is that by partnering with an epayments focused b2b payments partner, you'll be on track to converting a high percentage of your payments to those most financially beneficial to you.

Here's a quick perspective on b2b payment types and costs:

Another cost consideration for merchants accepting this payment type is the amount of interchange that is deducted from the transaction. In other words, some vendors have advantages in this area via lower interchange rates through various pre-established processing rates due to their agreements they have in place with the various card networks. Regardless of the interchange, the virtual card represents the best option for many accounts payable departments to monetize their payments stream in a sustainable manner, and one which is only growing in the market and offers high security standards and numerous business advantages.

This can be down to each company's individual payments process, but it certainly helps when you have a standard operating procedure that is repeatable and optimal when it's automated. Most solid b2b payments partners have robust technology stacks that will set, retain, and automate payments to vendors factoring their preferences on your behalf so that payment execution is streamlined and optimized for your business where possible.

If you haven't taken the time to really establish a solid b2b payments strategy, it's a crucial thing to do as it will certainly influence whether you have need of a b2b payments partner as we've looked at in this brief. If you're wondering about you can improve, we encourage you to check out the eBook below that talks about four keys of maximizing the value of accounts payable...it'll help you on your journey.

In today’s economy, speed to cash is as important as speed to market. Companies that let receivables linger for 60, 75, or even 90 days are putting...

Managing operational costs today often means balancing operational costs against tight margins, making it essential to join a group purchasing...