Automated Accounts Receivable Programs: Cutting DSO by 30% in Six Months

In today’s economy, speed to cash is as important as speed to market. Companies that let receivables linger for 60, 75, or even 90 days are putting...

3 min read

January 5 2017

by

![]() Chris Cosgrove

Chris Cosgrove

In today’s post, we want to take some time to review some interesting trends we encountered in our recent industry readings and glean some key information from them. We’re going to focus specifically on the issue of financial reporting and the direction it’s heading, especially as it relates to areas like AP automation, and some of the implications around it. For many finance professionals it might be high time to use some new, advanced technology to boost productivity, hence the lever and gears.

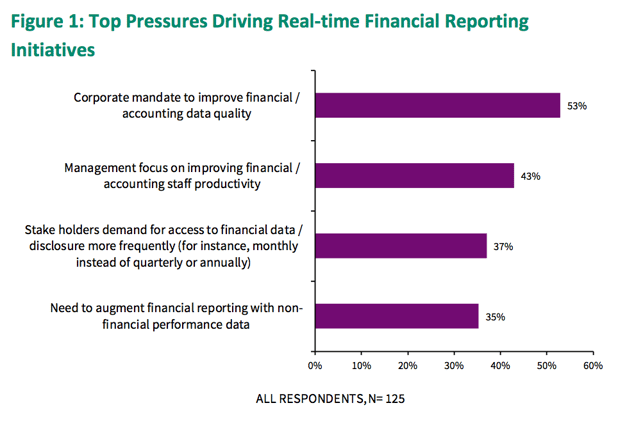

Research from Aberdeen Group shows that many businesses are desperately seeking to turn the tables on how reporting is done within their organization in order to be more efficient with their time and effective with their people. This is reflected in the infographic abovethat reflects the pressures that are being exerted upon Finance organizations across the world. We find it interesting that the top two pressures driving this change are predominantly centered around quality control initiatives and on boosting staff productivity. This may seem like old hat for champions of automation like ourselves, but it’s crucial to remember that many companies are still running their businesses on spreadsheets. While it does get the job done, there are far more powerful and time saving tools available to alleviate these burdens and eliminate the limitations imposed by such approaches.

We find it interesting that the top two pressures driving this change are predominantly centered around quality control initiatives and on boosting staff productivity. This may seem like old hat for champions of automation like ourselves, but it’s crucial to remember that many companies are still running their businesses on spreadsheets. While it does get the job done, there are far more powerful and time saving tools available to alleviate these burdens and eliminate the limitations imposed by such approaches.

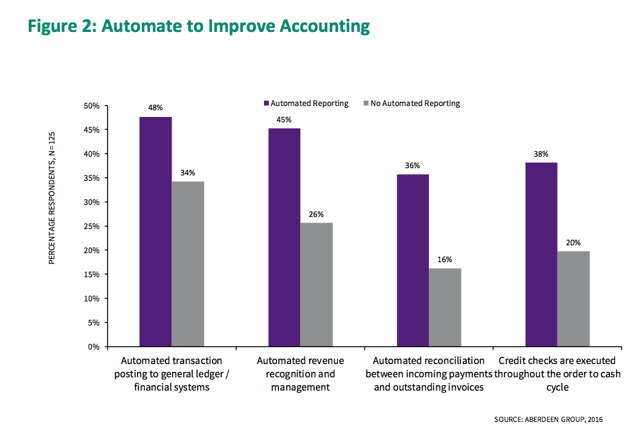

Another interesting finding from the study, which we recommend by the way and which can be found here, is that data accuracy is generally a byproduct of automated systems which facilitates faster and better reporting cycles, be they spontaneous (eg. audits) or scheduled (eg. period closes). Either way the table above show some of the common impacts on reporting via automation. In the case of transaction posting, nearly 48% of businesses who have this feature also have automated reporting. We find this interesting as this corroborates what we do on a daily basis with respect to our clients. If you consider the process and heavy lifting of advanced data extraction and verification, data validation (against procurement and receiver data), and ultimately data release, it’s no wonder that businesses that have had the foresight to deploy AP automation systems have a leg up on the competition from a reporting standpoint. Our argument in this area is that once you have the data unearthed and cleansed from the process outset you essentially have the mithril. For you non-Tolkienites, you’ve got an invaluable precious resource that will enable you to unlock tangential processes to include financial reporting with more accurate and even automated reports.

We hope that you found this insightful and we want to thank Aberdeen Group for their excellent research in Drowning in Report Preparations? Let Automation Keep You Afloat by Keir Walker, Senior Research Associate in December 2016.

In today’s economy, speed to cash is as important as speed to market. Companies that let receivables linger for 60, 75, or even 90 days are putting...

Managing operational costs today often means balancing operational costs against tight margins, making it essential to join a group purchasing...