Automated Accounts Receivable Programs: Cutting DSO by 30% in Six Months

In today’s economy, speed to cash is as important as speed to market. Companies that let receivables linger for 60, 75, or even 90 days are putting...

You can source that to Oliver Wendell Holmes or Ralph Waldo Emerson, depending on your search results, but the notion stands nonetheless. In the accounts payable automation arena, it's especially true and our brief today is primarily aimed at helping you understand the accounts payable metrics that you can measure and manage in ways that perhaps you previously couldn't. We've routinely heard time and time again from the various finance leaders we're consulting with that in manual accounts payable environments, they have little to no visibility or control over a given process. At best it's limited visibility, which leads to suspect decision making and often times creates negative consequences to the business.

a). Approval processes: when it comes to invoice approval processes, not having invoices in an automated electronic workflow means zero insight into where the process is at and who has responsibility over a particular transaction or set of transactions. This could mean bottlenecking to a process if an approver must authorize a transaction and / or assign a GL code to it.

b). Payment dates: if you don't have a timeline for paying bills that is clearly visible and articulated in such a way that you can prioritize payment based upon due dates, you could easily be setting up to pay your vendors late and in so doing incur late payment fees that are both unnecessary and unprofitable.

c). Invoice status: if you're not assigning a status to your invoices, regardless of whatever stage they are at with respect to how you currently process them, it means that you can't explicitly identify exactly where they are at in the process. This stinks, especially if you're having to manage vendor relationships and they call into you turning the heat up on you to provide them needed payment details.

These are just a few examples of some of the pains that literally thousands of businesses just live with despite the fact that there are automation technologies that can lift them above the mire that is manual accounts payable.

It's a good thing you asked that and we want to devote the rest of this piece to addressing that to shed some light. For starters, we want to start on things that have immediate tie-backs to efficiency and translate to fiscal impacts.

1. Time saved - When you can start to gauge how long things are taking to process especially by type of invoice you are processing you can start to gain perspective for what's moving quickly or slowly and then begin to analyze why. Only once you understand the landscape for opportunity and benefit can you start to make the adjustments necessary to improve.

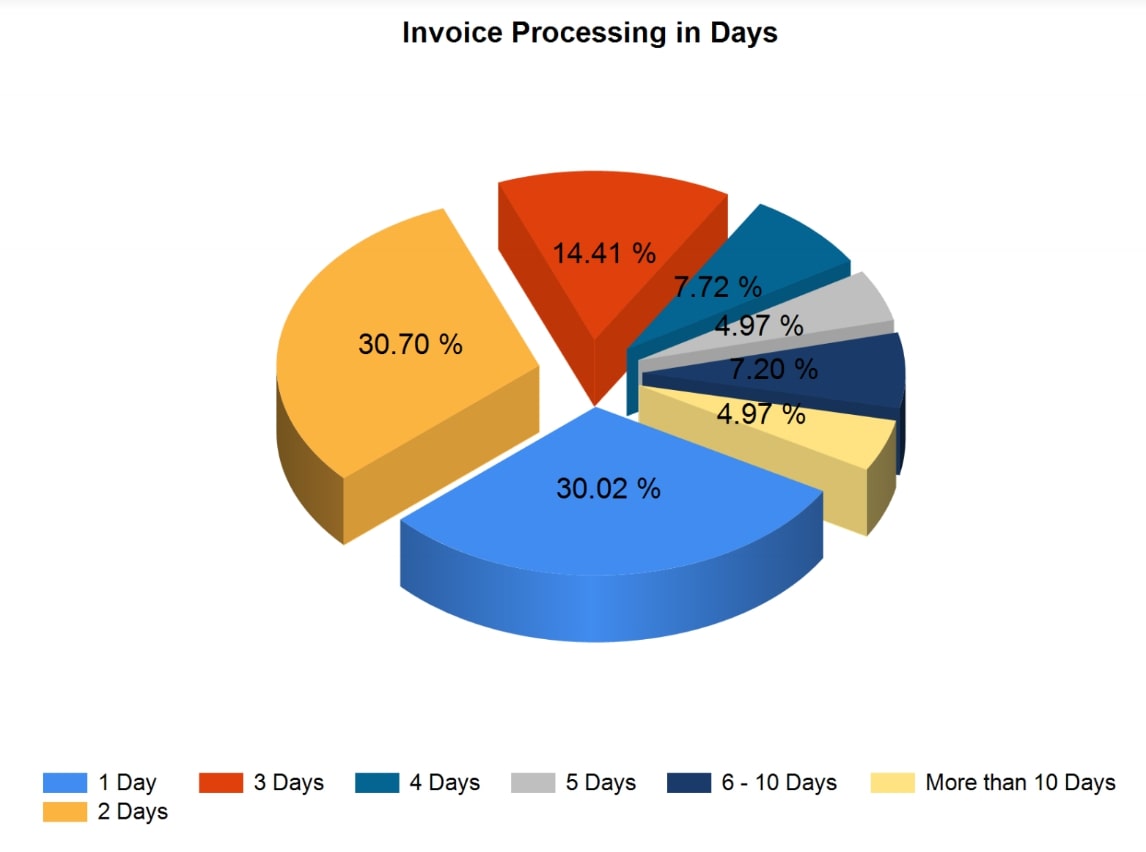

Another of the accounts payable metrics that’s foundational is invoice processing in days as you can quickly see how efficient or not you are at cranking through your invoices from presentment to posting. This also has obvious implications when evaluating individual processor productivity and can lead to establishing new standards for what’s possible per full time employee via accounts payable automation!

2. Accounting Staff Productivity - This may be something that is more relevant in larger AP departments, but nonetheless if you have a staff larger than one it may be helpful for you to understand who is processing what set of invoices and how efficient they are at their job. Additionally, tying into point #1 above, you can start to overlay the subset of invoices that they are responsible for as a consideration for their actual workload and as such, gain insight into why they may excel or lag behind in terms of efficiency. Essentially, you can use benchmarking and reporting within a robust accounts payable automation platform to give you the data you need to better manage your own staff.

3. Discount Capture - One of the easiest ways to flip AP into a profit center is through the capture of early payment discounts. Far too many businesses do little or nothing in terms of pursuing these opportunities. For some it's a lack of awareness or tenacity to pursue them...for others it's lack of visibility into what's available and for others it's a lack of execution. Jumbled systems and no insight into what's on the horizon for early payment discount opportunities means chances squandered. By managing a dynamic process against a dashboard interface factoring real time data, you can quickly assess what a legit opportunity to pay less and thus create dynamic savings for your business looks like. Once identified it can be executed on and the max value for AP can be achieved. It doesn't take a ton of capture from a percentage of relative spend basis to offset the cost of an empire AP team, and we've seen these types of numbers scale substantially depending on the size of the business, making this an absolute gold mine of an opportunity.

4. Approver Efficiency - Accounts Payable staff is by no means the only subset of people in an organization that can aid or impede the efficiency of a process. For Non-PO based invoices approvers have their part to play. By getting insight into your stack of approvers and how quickly they are turning invoices in the system you can make strides to squash bottlenecks before they arise. Advanced accounts payable automation systems will allow you to put hedges in place over a process by way of automated delegation in the event someone is sick or on leave so that invoices can flow to another approver for payment authorization. Additionally you can use time-based escalation protocols to level invoices up to get to a decision maker that can take action before you lose discount opportunities or get jacked by late fees.

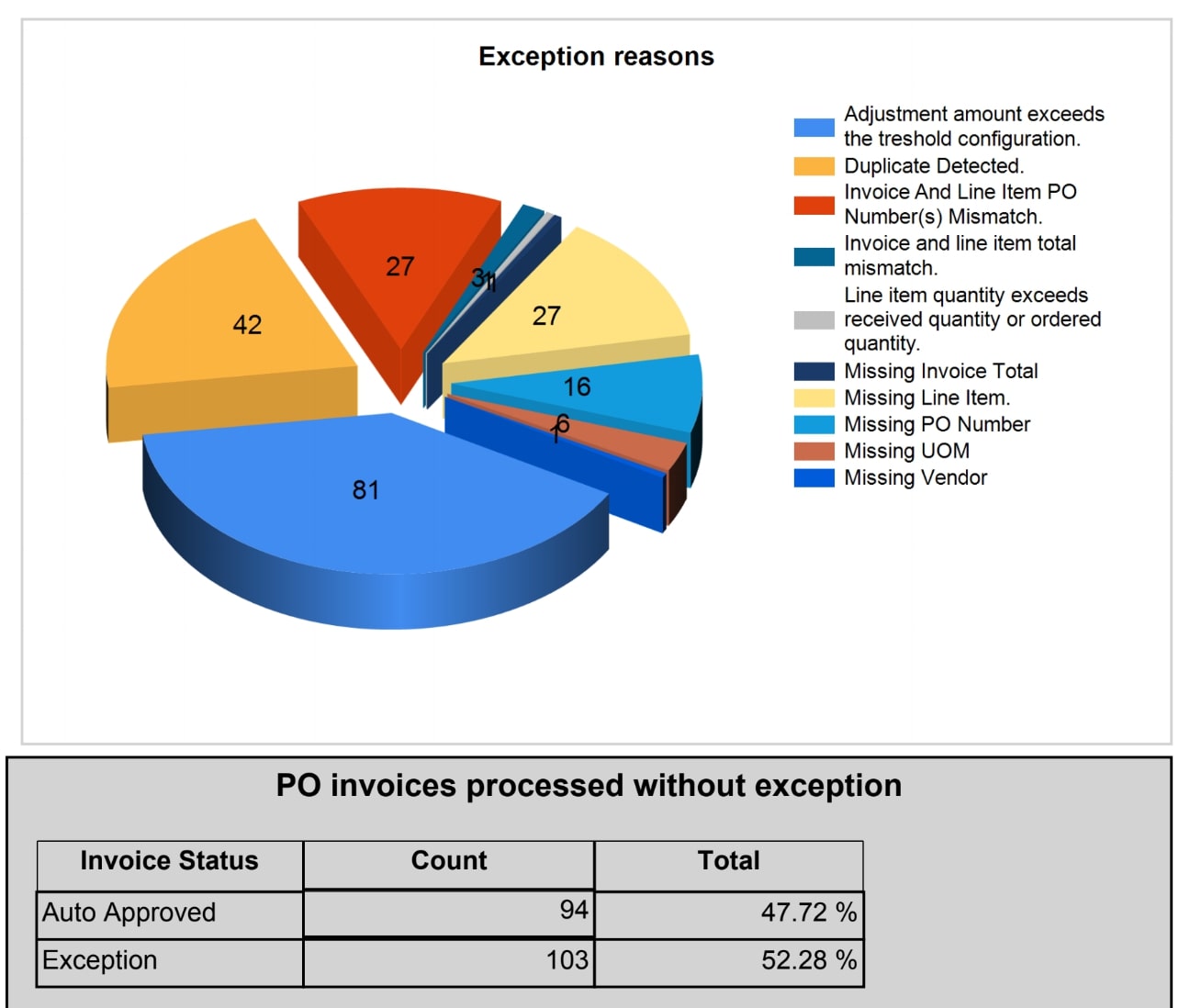

5. Exception Rates - Again in line with understanding the core of a matter, getting to know how invoices are flowing through your process is key and more importantly understanding what types of invoices are kicking out as exception to the process is paramount. This can help you isolate where the root of the problem is...for instances, if you keep getting line item and pricing mismatches on PO based invoices, it could mean you've got a sloppy procurement person on staff who needs to get their act together so the good of the team is promoted or it could mean you need to reach out to your vendors so you can get on page in terms of pricing or whatever the issue is. Bottomline is when you can see what the exception rates are especially by type of invoice your processing or by vendor you can do a deeper dive and enhance the process on a go forward basis.

Getting this kind of clarity into your accounts payable process via the visual manipulation of accounts payable metrics is massive, especially when looking to prove out business case justification for the gains of AP automation!

6. Straight-through processing - One of the hallmark accounts payable metrics to get excited about...essentially it represents the subset of invoices that move through your payables environment with zero manual touches. For anyone who is a manager of the ap process, this is one of the most common desires that we've heard expressed...less manual intervention, less keystrokes, more time saving. Well, the goal of accounts payable automation is obviously to move as many transactions into the sphere of automated invoice processing where the automation technology is driving invoices along their respective tracks and in many cases it's possible to push a large subset through when you have solid validation techniques in place and 2 or 3 way matching executing and validating itself. If everything is netting together from either an invoice and PO document (or with a receiver on top of it), why would it need manual intervention. The higher you can crank this subset of invoices percentagewise the happier you'll be. It means you'll be getting more for your investment into automation and this becomes the real juice to transforming the front end of invoice processing.

7. Percentage of suppliers accepting electronic payments - An additional insight that is crucial is tracking the number of vendors that are accepting electronic payments. Why? For starters ePayments cost far less (check this post out on that front). But also, integrated payables, and specifically virtual credit card payments represents one of the primary ways you can monetize your payment stream and literally flip AP into a sustainable and sizable profit center. If you're not actively pursuing integrated payables you are behind the curve and suffering for it. This represents the lowest hanging fruit in terms of making smart and low risk decisions for improving AP and can be done before or after automation AP invoice processing.

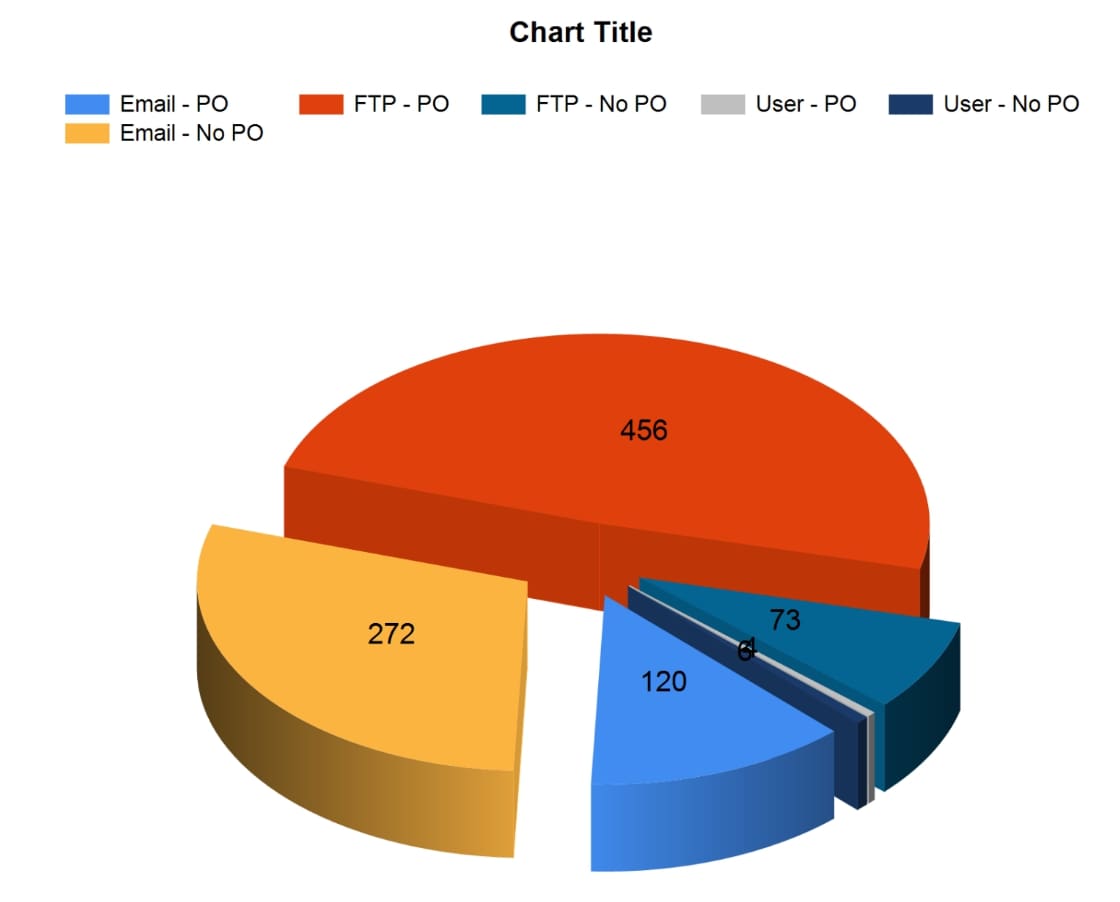

8. Percentage of invoices tied to a purchase order - This may not matter much to you but if it doesn't, it could. It all depends on how you enact controls and what your comfort level is with getting requisitioning authorization front end in the process. If that's something you want up front then this is a metric you're going to care about. Essentially you'll be tracking the flow of invoices in your businesses that have originated from such a process and thereby be harnessing this subset of accounts payable metrics to effectively gauge your level of control over your purchasing process.

Accounts payable metrics like PO vs No PO tracking is pivotal for gaining insight into the degree to which you have solid controls in place over your process to curb unauthorized spend or the potential for fraud.

9. Accrual Reporting - If you're going through a month end machination by calling out to various department heads or approvers to get a lay of the land in terms of the invoices that they may be sitting on or know will be coming in you are living in the dark ages. When you have all invoices converted to data upon immediate receipt into your process you've got the data at your fingertips and that entire effort of inquiry can be shoved off a cliff and with a higher degree of accuracy than what you may previously have known. This is a massive win for any AP manager or controller who is doing this at each month end.

There’s really not a limit to the number of key performance indicators or accounts payable metrics that you can track when you have a digitized, automated process in place that gives you rich and dynamic reporting capabilities you can really unearth the gems that will help you attain better business outcomes. From advancing tighter controls over the process, to driving internal accountability, to reducing cycle times, to monetizing your process and enhancing its strategic value the possibilities afforded through tapping into accounts payable metrics are limitless. We invite you to continue your learning by checking out the ebook below on the four keys to maximizing the value of accounts payable.

In today’s economy, speed to cash is as important as speed to market. Companies that let receivables linger for 60, 75, or even 90 days are putting...

Managing operational costs today often means balancing operational costs against tight margins, making it essential to join a group purchasing...