Automated Accounts Receivable Programs: Cutting DSO by 30% in Six Months

In today’s economy, speed to cash is as important as speed to market. Companies that let receivables linger for 60, 75, or even 90 days are putting...

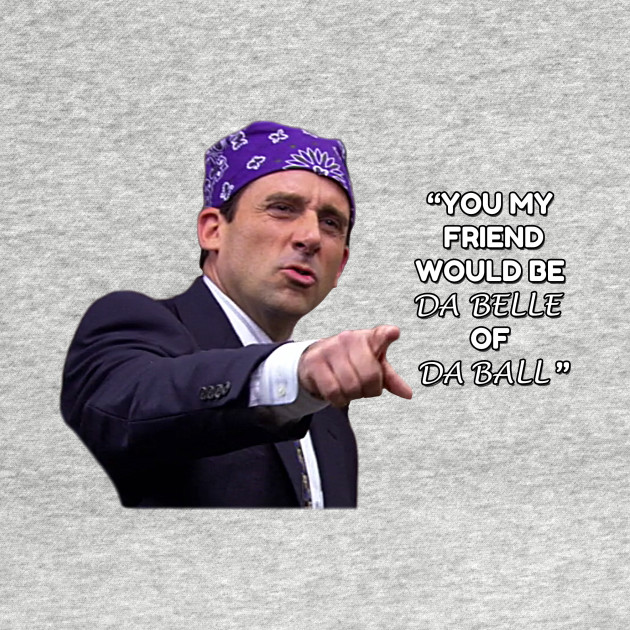

SMB’s can hardly be categorized “da belle of da ball” in the now famous Michael Scott, aka “Prison Mike” vernacular. While they may have a bridesmaid and not the bride type rap, SMBs (small and medium businesses) make up nearly 97.9% of the United States’ 5.83 Million employer firms. That is nothing to bat an eye at and until now has represented one of the last frontiers that is primed for process automation.

There are a variety of ways that automation is happening to the financial back office of the small business, whether you look at banking apps that simplify how checks get processed through mobile capture and manual indexing to things like accounting systems in the cloud that sync with your credit card provider to eliminate subsequent journal entries.

Some of the other, harder to reach areas include things that big corporates have been tackling for a while...invoice processing automation, epayments, and the like. The intersection of these technologies, especially now through cloud based delivery methodologies essentially means a world of possibilities for small business leaders. Not only can their processes be improved and transformed so they are virtually hands free and so that they have complete visibility, but they can literally be engineered to make their businesses make money. This is no longer the realm of the big corporate only because cloud-based delivery has upended the traditional install based deployment model and paved the way for businesses of all shapes and sizes to follow in their footsteps.

With the expansion of repeatable integrations to key core SMB platforms like Quickbooks, Xero, Sage and such, moving data in and out is no longer a boondoggle and when we’re talking about automating how transactions get logged into a system that is otherwise reliant on manual entry, data manipulation and release is EVERYTHING.

If this seems too good to be true, well believe it. We’ve seen numerous clients fully automate their process and enjoy the financial and operational benefits to automation and you can see that here!

In today’s economy, speed to cash is as important as speed to market. Companies that let receivables linger for 60, 75, or even 90 days are putting...

Managing operational costs today often means balancing operational costs against tight margins, making it essential to join a group purchasing...