Automated Accounts Receivable Programs: Cutting DSO by 30% in Six Months

In today’s economy, speed to cash is as important as speed to market. Companies that let receivables linger for 60, 75, or even 90 days are putting...

If you don’t know who Marcus Aurelius is, we don’t blame you. He lived a while back, like just about 2,000 years ago, but if you’ve seen Gladiator, at least you’ve seen Hollywood’s take on the man. Not bad if I might add, and one that was at a minimum entertaining and eye opening to say the least. But what does this have to do with eInvoicing and Accounts Payable automation…? Well nothing, and everything, if you take the quote above in context.

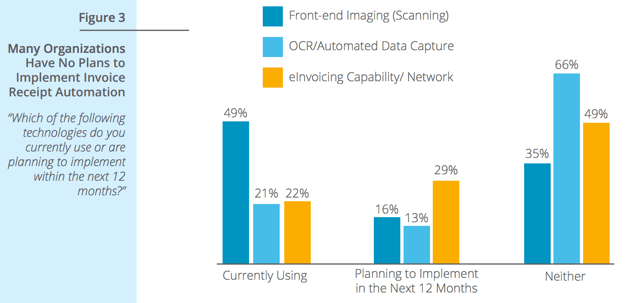

In today’s crowded Accounts Payable process improvement market there are numerous opinions and approaches vying for attention and adoption. Each stands on its own merits, but ultimately metrics around adoption tend to tell a clear picture. For some reason, eInvoicing, despite its advanced features and efficiency still lags far behindtraditional AP automation even after years of promotion. According to Invoice Receipt Management by Paystream Advisors in 2015, eInvoicing adoption is lagging significantly behind traditional front end OCR capture processing scenarios.

While the chart suggests that eInvoicing as a trend could increase in the future, it’s at a statistically similar pace to front-end imaging and OCR capture. We believe that it is unlikely for this trend to materialize because people are abhorrent to change. Essentially eInvoicing, despite its technical advantages, is a complete bear to deploy. It is expensive, time consuming, and an enigma to many suppliers who will need to interact with it. Left to their own devices, people are averse to change. That’s why in the countries where this methodology has flourished, it has always taken some kind of centralized governance initiative by the federal government to force adoption. Unfortunately, for those in the west, this is not going to happen any time soon, especially in the wake of the deregulation trends of the Trump administration.

From our perspective Accounts Payable automation leveraging dynamic front-end invoice capture and data validation represents the most flexible way to ingest invoices of all formats and get high rates of data accuracy and efficient throughput. Once you’ve got invoices in and converted to data, you have to harness intelligent workflows, and reverse lookup matching capabilities to get rid of manual process, whether traditional approval processes or all the manual matching that has to occur for PO based invoices. Then you’ve got dynamic data release to the back end system where the transactions will reside and ultimately invoke payment. Now, we get that the approach has been around for some time and isn’t necessarily the newest tech on the block, but why fix what isn’t broken?

In fact, if you’re savvy and you start connecting an automated ePayments approach, you can monetize the process quite a bit, leverage the cash returns to fund automation, improve and optimize the process for more gains (ie. early payment discount capture) and achieve maximum process value.

The key from our perspective is harnessing the delivery infrastructure in the cloud instead of the older method of deploying everything onsite. Fewer businesses today are interested in maintaining additional systems in house on servers because it requires capital investment and administration, which just ties up human resources and cash.

So, in wrapping it up, it’s not that eInvoicing is inferior to Accounts Payable automation, it’s just that it has so many more barriers to adoption and nothing pushing it forward from a mandate standpoint. In other words, if you can streamline your process by upwards of 80%, monetize it and flip it from a cost center to a profit center that is tied in tightly to your Treasury function, have immediate visibility to anything in your system, and do all this without having to solicit your vendor base and force your AP team into a quasi sales/evangelism role, why wouldn’t you?

In today’s economy, speed to cash is as important as speed to market. Companies that let receivables linger for 60, 75, or even 90 days are putting...

Managing operational costs today often means balancing operational costs against tight margins, making it essential to join a group purchasing...