Automated Accounts Receivable Programs: Cutting DSO by 30% in Six Months

In today’s economy, speed to cash is as important as speed to market. Companies that let receivables linger for 60, 75, or even 90 days are putting...

2 min read

December 22 2015

by

![]() Chris Cosgrove

Chris Cosgrove

One thing is for certain, he wasn’t cowed by too many folks in the pursuit of his dreams, and we’d argue that he was steadfast even in the face of numerous opinions of people who just didn’t get what he was trying to do. Such is the fate of anyone taking on a worthy initiative. Why should this be any different for those who are trying to champion Accounts Payable automation. The thing is, that unfortunately, many corporate leaders are legacy and due to political power structures, or departmental silos, turf wars and skirmishes emerge over who is going to champion a process improvement project. And so dies many an initiative before it ever had a shot of getting off the ground.

So, from our heart to yours, we want to equip the person who has a vision and a dream to transform the nature of their Accounts Payable process with the tools they’ll need to eviscerate, obviate, or otherwise derail any would-be hater that comes their way.

If you’ve done an exhaustive assessment of your current accounts payable process, you’ll know how you stack up to other companies from a benchmarking standpoint. In our experience it’s the majority of CFO’s that don’t actually have a firm handle on what their unique business metrics are from a processing perspective. For example, items deemed non-critical often get little attention. With regards to invoice processing, the cost to process an invoice can vary wildly from around $3 per invoice in a highly automated environment to over $15 in a paper-centric, manual environment. Consider the delta of $12 per transaction times the number of transactions. At a mere, 1,000 transactions a month, the difference would be a swing of $12,000 to the good (or bad depending on your. Invest the time to analyze where you can slash wasted cost and bring your analysis to the forefront in the conversation. Oh yeah, by the way, we offer that up as a freebie if you want some help with that...just click here!

Sometimes cost-cutting isn’t enough. As an example, cost cuts can mire down between hard and soft expenditures, and some organizations won’t affect active headcount reduction to achieve certain hard savings. Others may push costs (labor) onto another task area, if someone is strategically redeployed, but strategic gains are another matter.

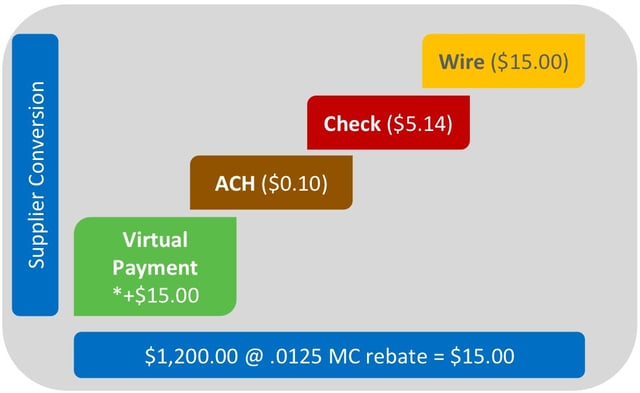

Consider the equation we laid out earlier on the delta of automated and non-automated invoice processing costs. The same principle goes for check cutting. The difference here is strategic thinking can cut certain check processing costs down to zero and be leveraged to drive operational profit. Specifically, I’m talking about making payments strategic in the form of virtual payments. The average cost to process a check per TAPN is $5.14. However, on a $1200 invoice earning the payer 125 basis points, which is standard on many virtual Mastercard payment programs, the rebate earned would be $15 with a $0 processing cost. In effect, you have a $20 swing per transaction, so assuming 1,000 checks per month, that’s a complete gain of $20,000, not just in theoretical dollars but actual rebates. When you start talking about true cash impact, it becomes harder to hate away.

*Average processing costs for traditional forms of payment compared to virtual payments. - per ComData

We also are cognizant of the fact that there are certain scenarios where internal politics hamper progress, as people defend their fiefdoms or look out for their own interests. Hopefully you can leverage some of the thinking we’re proferring to make headway even in adverse waters. If you can’t ultimately win hearts and minds though with executive leadership, you’re likely not to affect much change operationally and if that’s the case it might be time to consider finding more forward thinking pastures.

In today’s economy, speed to cash is as important as speed to market. Companies that let receivables linger for 60, 75, or even 90 days are putting...

Managing operational costs today often means balancing operational costs against tight margins, making it essential to join a group purchasing...