Automated Accounts Receivable Programs: Cutting DSO by 30% in Six Months

In today’s economy, speed to cash is as important as speed to market. Companies that let receivables linger for 60, 75, or even 90 days are putting...

6 min read

September 16 2024

by

![]() Chris Cosgrove

Chris Cosgrove

Migrating from paper invoice and payment processing methods can seem like a big endeavor, but these steps will help you adopt automation faster and easier.

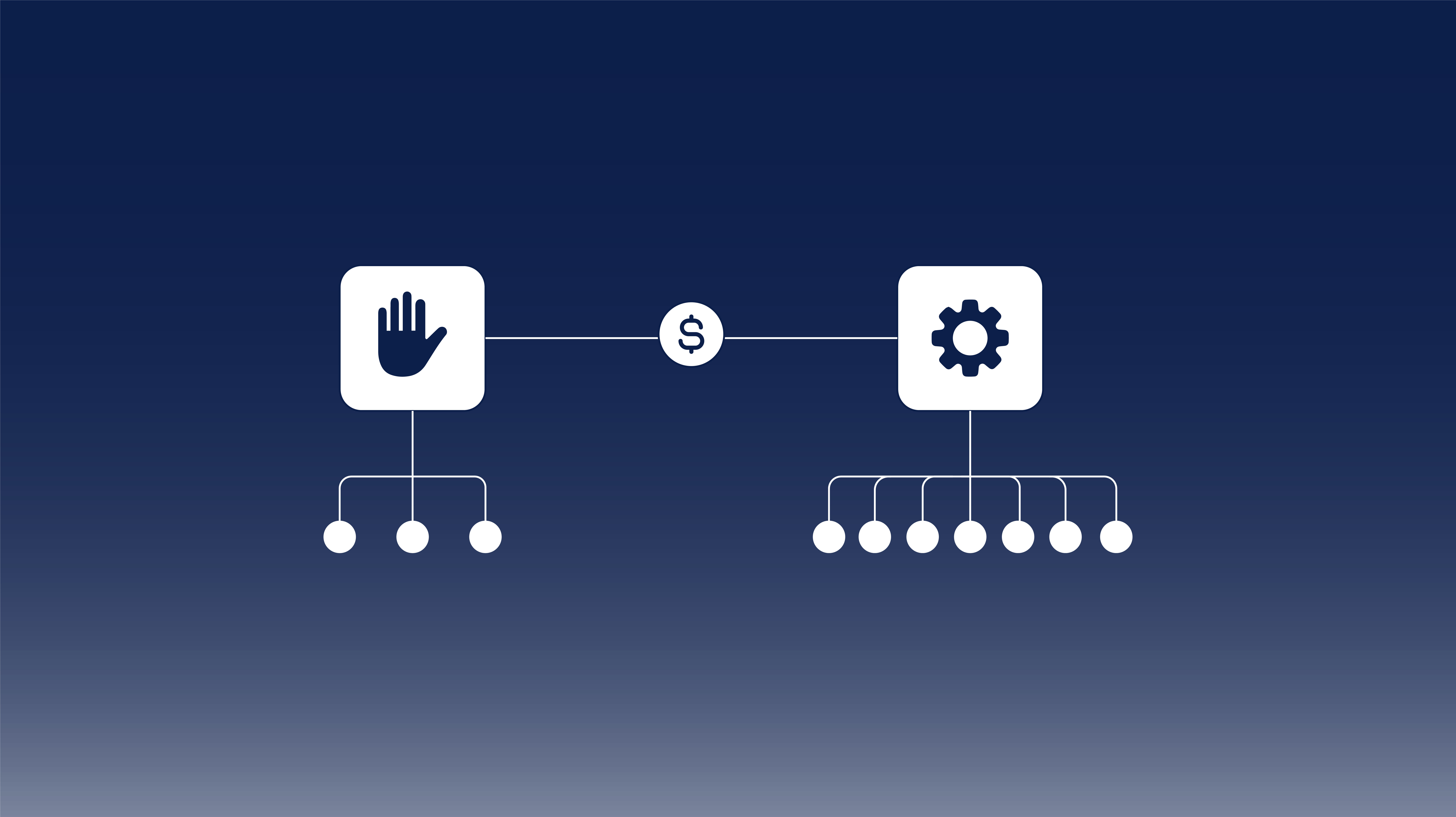

Switching from manual to automated payments in accounts payable (AP) is no longer a distant consideration for modern businesses—it’s becoming a necessity. Above that, the outdated, cumbersome processes of manual payments are giving way to more efficient and secure automated payment systems able to streamline processes by over 90%.

Businesses that resist this change are at risk falling behind, resulting in delays, inefficiencies, and missed opportunities for cost savings. This guide will walk you through each step of transitioning from manual to automated payments and help your AP department make the shift smoothly and successfully in the near future.

Before diving into automation, it's essential to understand the state of your existing payment processes. How does your business currently pay vendors? What steps are involved in invoice processing, approval workflows, and payment execution? Take some time and map out your current procedures to uncover the inefficiencies and bottlenecks that could be costing your AP department a lot of time and money.

The reality is, many payment issues stem from invoice reconciliation problems and siloed data, factors which make it difficult to process information efficiently. Additionally, without a way to inform vendors about invoice statuses, the potential for vendor dissatisfaction increases significantly.

As you complete an overview of your payment structure, take note of any delays in invoice approvals, duplicate payments, or errors in manual entry that slow down processes. Determine what communication breakdowns occur between departments. Ask whether vendors frequently complain about late payments. Understanding these issues will not only highlight why manual payments aren’t sustainable but will also make it clear where automation can offer improvements.

Once you've reviewed your payment structure, it’s time to explore automation software. Payment automation systems offer numerous benefits—reducing manual work, increasing accuracy, and speeding up payment cycles. But not all solutions are created equal, so you will want to find one that aligns with your company’s specific needs.

When evaluating payment automation software, consider factors such as integration with your existing accounting system, ease of use, scalability, and cost-effectiveness. A good payment automation system should streamline payment processes from end to end and include invoice capture, approvals, and disbursements. Additionally, robust security features like fraud detection and secure data management should be non-negotiable.

As you work to find the right fit, make sure to engage with potential providers and ask the right questions. Ask how their software handles various payment methods, whether it supports international payments, and whether the software includes options for vendor self-service portals.

Transitioning to automated payments isn’t just an operational decision—it’s a strategic one that will impact your entire business. With this in mind, gaining executive buy-in is crucial to making this transition smooth and effective.

Overall, executives are more likely to support automation when they understand the long-term benefits, so that means you need to emphasize how automated payments reduce costs, increase efficiency, and mitigate the risk of errors and fraud. Additionally, make a point to highlight the improved cash flow management and real-time visibility into financial data; this will help executives make better business decisions.

Automation also frees up valuable time for your AP team, enabling them to focus on more strategic tasks rather than being bogged down by manual payment processing. The benefits of this factor can be far reaching and pay out well after an automation implementation.

Once you’ve secured executive buy-in, the next step you need to take is to prepare for the implementation of your chosen payment automation solution. A successful implementation begins with detailed planning and will involve key stakeholders from your finance, IT, and procurement teams.

Start by setting clear goals for transition and establishment of the automation solution. You'll also need to configure the software to meet your specific requirements, including integrating it with your existing accounting or ERP system.

Additionally, think about change management. Automation will change how employees work, so you need to ensure that all relevant personnel are adequately trained on the new system. This will not only help reduce any initial resistance to the change but will also ensure a smoother rollout.

Before fully launching your new automation solution, conduct a test run. This stage allows you to identify any issues and ensures your software works as expected without disrupting daily operations.

During this test phase, train your staff on using the software so they become comfortable with getting started. Proper training will be critical for adoption, as your AP team needs to feel confident in operating the new system. Create step-by-step guides or host hands-on training sessions to familiarize them with the software’s interface and functions. Lean on the automation provider to guide you through this process.

In parallel, this is also a prime time to get your vendors onboard. Automated payments will likely require a shift in how vendors interact with your company, so the time to get acclimated is now. For example, if you plan to switch from checks to ACH payments or virtual credit cards, you’ll need to notify vendors and work with them to make the transition as seamless as possible. Vendors may also need to digitize invoicing and clear communication will be key to ensuring they are ready for the change.

After a successful test run, it’s time to fully launch your automated payment system, and this process will typically involve collaboration between your internal teams and your automation provider. Most providers will offer support during the launch phase to help ensure the system is running smoothly and address any immediate issues that arise. To be certain, however, make a point to ask about this capacity before choosing a provider.

As you navigate the first few weeks with the new solution, monitor how well it integrates with your workflows and make any necessary adjustments. Employees should continue to receive support and training as needed, while vendors may require additional guidance on adjusting to the new process. In summary, keep communication open with all stakeholders to avoid frustration and resolve any concerns quickly.

Now that your automated payment system is up and running, it’s time to measure its effectiveness. Understanding the return on investment (ROI) of your solution will help you evaluate the success of the transition and demonstrate the value to executive leadership.

To begin, you will have several key performance indicators (KPIs) to track: First, calculate time saved by automating processes that were previously done manually. This could include reduced invoice processing times, fewer errors, and faster approval workflows. Next, examine cost savings from eliminating paper checks, late fees, and other expenses related to manual payments. You can also track improvements in vendor relationships; for example, are you paying invoices faster and are vendors happier with the streamlined process?

Finally, don’t forget about security. With automated payments, fraud prevention measures such as secure approval workflows and reduced paper handling can significantly lower your risk exposure, which should also be factored into your ROI calculation.

Transitioning from manual to automated payments is not just about increasing efficiency—it’s about future-proofing your business. In essence, businesses that invest in payment automation gain a competitive edge and free up time for their employees to focus on strategic initiatives while enhancing security, reducing costs, and improving vendor relationships.

Follow the steps outlined in this guide to help you make the automation switch with confidence, and then start reaping the rewards of more streamlined, automated payment processes.

For assistance in completing these steps, please request a free consultation with CloudX by filling out the online form here. We will be happy to walk you through each and provide you with a demo of our invoice and payment automation solutions.

In today’s economy, speed to cash is as important as speed to market. Companies that let receivables linger for 60, 75, or even 90 days are putting...

Managing operational costs today often means balancing operational costs against tight margins, making it essential to join a group purchasing...