Automated Accounts Receivable Programs: Cutting DSO by 30% in Six Months

In today’s economy, speed to cash is as important as speed to market. Companies that let receivables linger for 60, 75, or even 90 days are putting...

2 min read

October 16 2014

by

![]() Chris Cosgrove

Chris Cosgrove

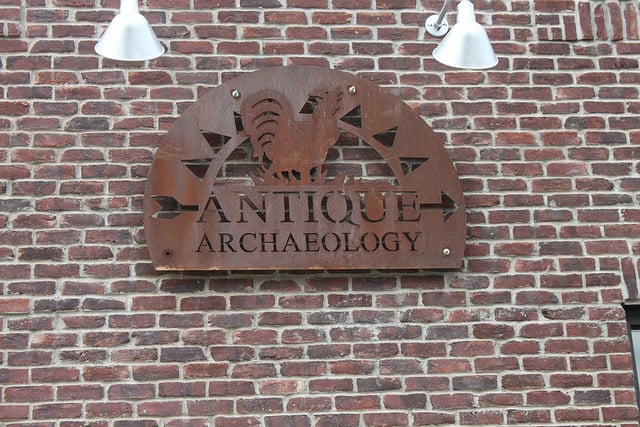

In recent years, much has been produced on Western TV and in literature with nostalgic themes as the undercurrent. Whether out and out of history or reality-themed shows, there appears a certain fascination with how things used to be and idolizing objects from bygone years for their craftsmanship, story, and design standards. Considering History channel hits like American Pickers or American Restoration, it’s a trend that is certainly not slowing down and is certainly remarkable. However, on an antithetical note, if businesses operated in the same mindset from an operational level, many of them would be run into the ground in short order. Certainly, there are elements to business operations that should always bear an homage to the business ancestry and traditions that got it to where it is, but never to ignore areas for streamlining and improvement that would mean significant advantage whether process-wise or financially.

With that said, there is a massive trend in how businesses conduct payments in supplier–consumer relationships. For decades, traditional invoice printing and check processing has been the gold standard for how business transactions (and personal) have transpired. In the last couple of decades, major corporations have significantly bettered their operations by investing in Electronic Data Interchange (EDI) transaction methods with their high-volume suppliers. This has resulted in streamlined Procurement, Accounts Payable, and Accounts Receivable scenarios for the lucky few that have pursued this. Successful EDI integration means that all the process documents like invoices and statements become a thing of the past and the data entry and processing elements get eschewed in the process. However, high technology like EDI is not a reality for the lion’s share of small and mid-sized businesses. Even large companies have not made EDI a broad-based reality for a myriad of reasons, including limited supplier adoption or lack of technical bandwidth to execute such initiatives.

Alternatively, many companies ranging from small to large are pursuing corporate purchase cards or credit card programs as a viable alternative to antiquated payment methods.

There is a multitude of additional reasons to consider going electronic with your payments, but this brief synopsis provides highlights of the major three that tend to have the deepest business impacts and advantage creation.

If you have not checked out virtual card payment options, learn more here.

Click here to schedule a few demo of our powerful AP Automation Software & Payables Software.

In today’s economy, speed to cash is as important as speed to market. Companies that let receivables linger for 60, 75, or even 90 days are putting...

Managing operational costs today often means balancing operational costs against tight margins, making it essential to join a group purchasing...