Automated Accounts Receivable Programs: Cutting DSO by 30% in Six Months

In today’s economy, speed to cash is as important as speed to market. Companies that let receivables linger for 60, 75, or even 90 days are putting...

2 min read

January 21 2016

by

![]() Chris Cosgrove

Chris Cosgrove

When I ask my 4 year old the color of an object, or its shape, I get concrete answers back...and quickly...sometimes too quickly!

However, when it comes to deeper things, the answers aren’t always so clear, and that’s why we’re posing the issue above as a question.

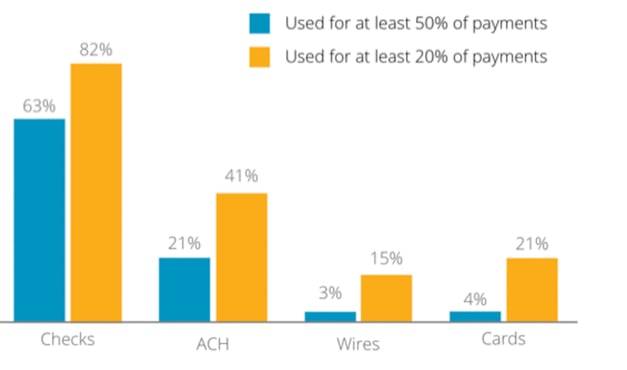

Here’s a look at the facts about payment methodologies for Accounts Payable departments in the US courtesy of Paystream Advisors

http://www.paystreamadvisors.com/effortless-transition-manual-electronic-payments/

What’s obvious from this chart is that most American businesses are still heavily reliant on check cutting to make payments. Considering that many businesses are looking to enhance their productivity and profitability it’s kind of ironic that they are dependent on antiquated and costly ways of doing things, and in this case, paying the bills.

When you couple the fact that cutting a check has an average cost of $5.14 per check according to The Accounts Payable Network, and that wires can exceed $15 per transaction, you can start to grasp the magnitude of what you are literally sending out the door. To do a quick analysis, just look at your non-payroll related checks that went out last year and multiply times those figures depending on your spread of payment types and you’ll have a healthy approximation for the total process costs you’re looking at.

So, there are certainly some compelling elements to making the case for virtual MasterCard, but probably none more-so than profitability. If you’re looking for a way to make your accounts payable process strategically valuable and profitable, then this is a key thing to consider!

In today’s economy, speed to cash is as important as speed to market. Companies that let receivables linger for 60, 75, or even 90 days are putting...

Managing operational costs today often means balancing operational costs against tight margins, making it essential to join a group purchasing...